Blockchain technology has been making waves in the business world, with its potential to revolutionize operations and create a more secure and transparent environment. Once solely associated with cryptocurrencies like Bitcoin, blockchain is now being embraced by businesses across industries for its ability to streamline processes, increase efficiency, and build trust. In this article, we will delve deep into the world of blockchain for business, exploring its various applications, benefits, challenges, and future potential.

Overview of Blockchain Technology:

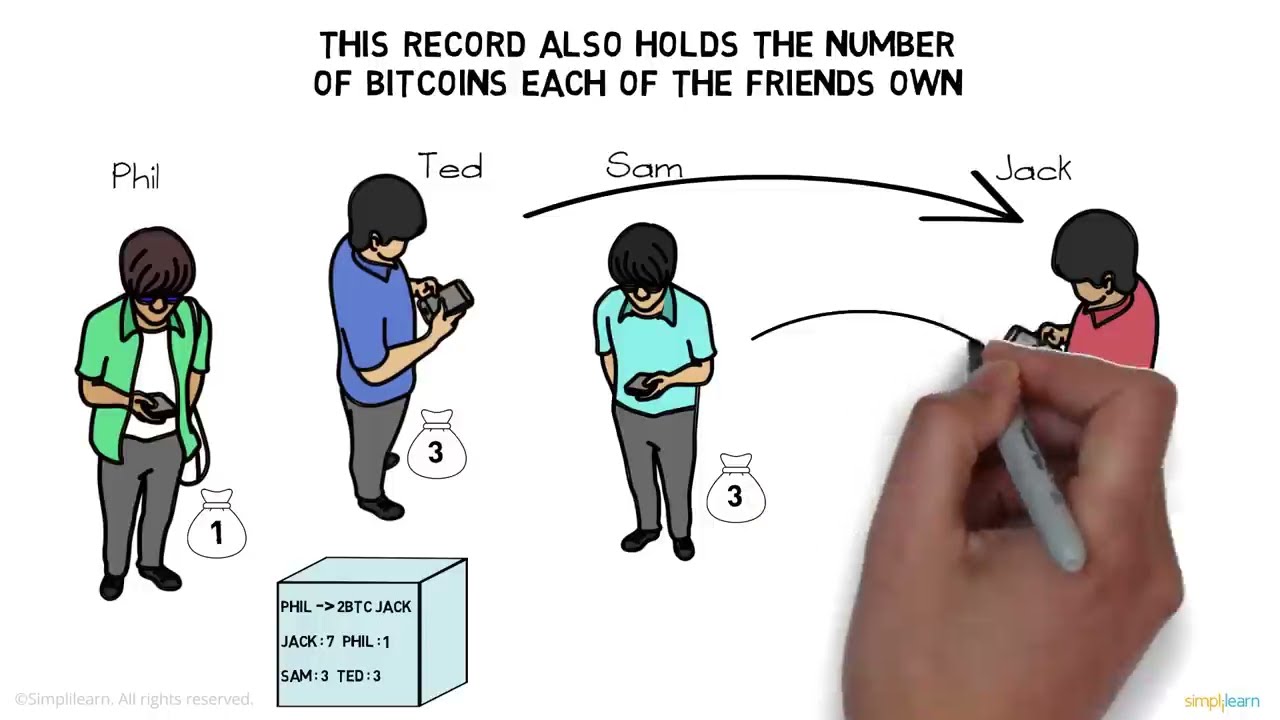

At its core, blockchain is a distributed ledger technology (DLT) that records transactions across a network of computers. This network, known as a blockchain, acts as a public, shared database that is constantly updated and synchronized across all participants. Each block on the chain contains a set of transactions, which are verified and added to the chain through a process called “mining.” Mining involves solving complex mathematical problems with specialized software, and once a block is successfully mined, it becomes a permanent part of the blockchain.

One of the key features of blockchain is its decentralized nature. Unlike traditional systems that rely on central authorities, blockchain operates on a peer-to-peer network, where each participant has a copy of the ledger. This means that there is no single point of control or failure, making it resistant to manipulation and censorship. Additionally, blockchain uses a consensus mechanism, where all participants must agree on the validity of a transaction before it can be recorded on the chain. This adds an extra layer of security and prevents fraudulent activity.

Another important aspect of blockchain is its immutability. Once a transaction is recorded on the blockchain, it cannot be altered or deleted. This is because each block contains a unique code, called a “hash,” which is generated based on the information in the block. Any change to the block’s information would result in a new hash, which would not match the one stored on the chain, making it immediately apparent that the block has been tampered with. This makes blockchain an excellent tool for maintaining data integrity and preventing fraud.

How Blockchain is Changing Business Operations:

The potential applications of blockchain technology in business are vast and varied. Let’s take a closer look at some industries that are already leveraging the power of blockchain to transform their operations.

Supply Chain Management:

Supply chain management involves tracking and managing goods as they move from suppliers to manufacturers, then to distributors, and finally to retailers. The traditional supply chain process can be slow, inefficient, and prone to errors. However, by using blockchain, businesses can create a more streamlined and transparent supply chain.

With blockchain, each step in the supply chain can be recorded on the ledger in real-time, providing a clear and tamper-proof record of the journey of a product. This allows for better traceability and accountability, making it easier to identify and address any issues that may arise. Additionally, blockchain can help reduce paperwork and automate processes, saving both time and money.

One notable example of blockchain being used in supply chain management is Walmart’s partnership with IBM. Together, they created a blockchain-based system for tracking and tracing food products from farm to store. By scanning a QR code on the product’s packaging, customers can see the product’s entire journey, including information on where it was grown, processed, and shipped.

Finance:

The financial industry is another area where blockchain is disrupting traditional operations. Banks and financial institutions are exploring ways to use blockchain to streamline processes, reduce costs, and increase security. One of the most prominent use cases for blockchain in finance is cross-border payments.

Currently, cross-border payments can take several days to complete and involve high transaction fees. With blockchain, these payments can be completed almost instantly and at a fraction of the cost. Blockchain can also improve the security of these transactions by eliminating intermediaries and reducing the risk of fraud.

Another exciting development in blockchain-based finance is the emergence of “smart contracts.” These are self-executing contracts that automatically enforce the terms and conditions agreed upon by both parties. This can help simplify complex financial agreements, reduce the need for intermediaries, and cut down on time and costs.

Healthcare:

Blockchain technology has the potential to revolutionize the healthcare industry in many ways. One of the primary areas where it can make a significant impact is in medical record-keeping. By using blockchain, patient records can be securely stored and shared between healthcare providers, eliminating the risk of lost or duplicated information.

Moreover, blockchain can also be used to track the supply chain of medications and medical devices, ensuring their authenticity and reducing the risk of counterfeit products entering the market. It can also help in clinical trials by providing a secure and transparent platform for tracking and analyzing data from different sources.

Case Studies of Successful Implementations:

The use of blockchain in business is not just theoretical; many companies have already implemented this technology with great success. Let’s take a look at some real-world examples of how businesses are leveraging blockchain to improve their operations.

Maersk and IBM:

Maersk, the world’s largest container shipping company, teamed up with IBM to create a blockchain-based platform called TradeLens. This platform digitizes and streamlines the complex supply chain processes involved in global trade. It provides end-to-end visibility of the journey of a shipment, reduces paperwork, and speeds up customs clearance. As a result, Maersk has seen a 40% increase in shipping speed and 15% reduction in administrative costs.

JP Morgan and Microsoft:

JP Morgan Chase, one of the largest banks in the world, partnered with Microsoft to create Quorum, a blockchain platform specifically designed for financial services. Quorum uses Ethereum-based smart contracts to automate and streamline processes such as loan origination and collateral management. This has helped JP Morgan save millions of dollars in operational costs and increase efficiency.

MedicalChain:

MedicalChain is a blockchain-based platform that allows patients to securely store and share their medical data with healthcare providers. This eliminates the need for physical records and allows for easier access to patient information, improving the quality of care. It also incentivizes patients to share their data by offering rewards in the form of tokens that can be used to pay for healthcare services.

Challenges and Risks of Using Blockchain:

While blockchain technology offers numerous benefits, it’s not without its challenges and risks. Here are some of the main concerns that businesses must consider before implementing blockchain solutions.

Scalability:

One of the biggest challenges facing blockchain is scalability. Currently, most blockchains are limited in the number of transactions they can process per second. For example, Bitcoin can only process seven transactions per second, while Visa can handle up to 24,000 transactions per second. This makes it difficult for blockchain to compete with traditional systems when it comes to large-scale operations.

However, there are ongoing efforts to improve blockchain scalability through various techniques such as sharding, which involves splitting the blockchain into smaller parts to increase transaction speed.

Regulatory Uncertainty:

The regulatory landscape around blockchain is still evolving, making it challenging for businesses to navigate. Different countries have different laws and regulations concerning cryptocurrencies and other blockchain-based applications. This creates uncertainty and potential legal issues for companies looking to implement blockchain technology.

Security Vulnerabilities:

While blockchain is highly secure, it’s not entirely immune to attacks. The Ethereum network was hacked in 2016, resulting in the loss of millions of dollars worth of cryptocurrency. Moreover, even though blockchain prevents double-spending, it’s still possible to manipulate the network by controlling the majority of the computing power. This is known as a “51% attack” and could potentially compromise the integrity of the entire blockchain.

Future Trends in Blockchain Technology:

As the use of blockchain in business continues to grow, we can expect to see some exciting developments in the near future. Here are some of the trends that may shape the future of this technology.

Interoperability:

Currently, most blockchains are siloed, meaning they cannot communicate and share data with each other. However, there is a growing need for blockchains to be interoperable, allowing for seamless communication between different networks. This would enable businesses to access and share data across multiple blockchains, increasing efficiency and creating new opportunities for collaboration.

The Rise of Stablecoins:

Stablecoins are cryptocurrencies that are pegged to a stable asset, such as fiat currency or gold. They provide the stability of traditional currencies while also taking advantage of the benefits of blockchain, such as fast and secure transactions. As more businesses look for ways to incorporate cryptocurrencies into their operations, we can expect to see an increase in the use of stablecoins.

Central Bank Digital Currencies (CBDCs):

Several central banks around the world are exploring the idea of issuing digital versions of their currencies using blockchain technology. These CBDCs would function similarly to physical cash but would be entirely digital and backed by the central bank. This could have a significant impact on the global financial system and potentially lead to widespread adoption of blockchain-based solutions.

Conclusion:

Blockchain technology is rapidly evolving and has the potential to transform the way businesses operate, interact, and build trust. Its decentralized nature, immutability, and security make it a powerful tool for streamlining processes, reducing costs, and increasing transparency. While there are still challenges and risks associated with implementing blockchain, the benefits far outweigh them. As we look towards the future, we can expect to see even more innovative uses of blockchain in various industries, unlocking the full potential of this revolutionary technology.