About this app

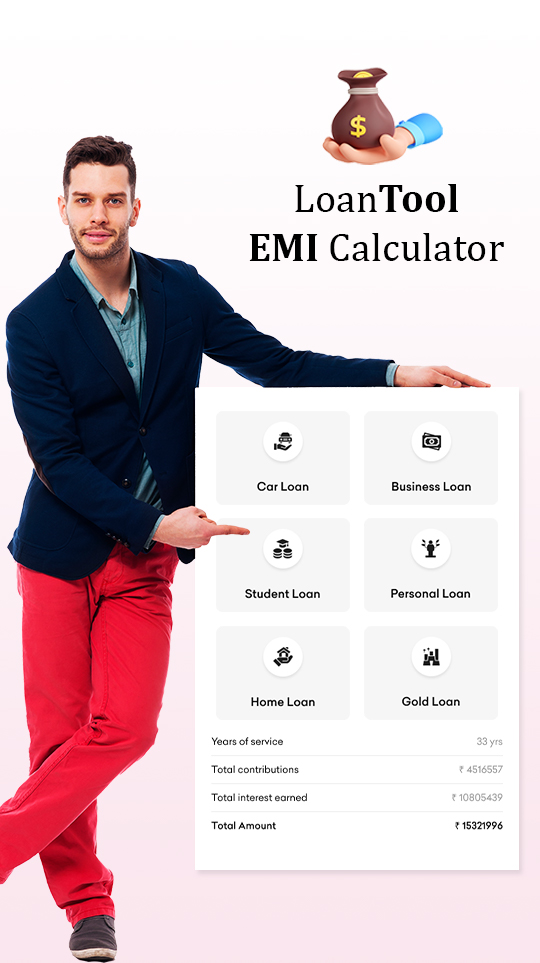

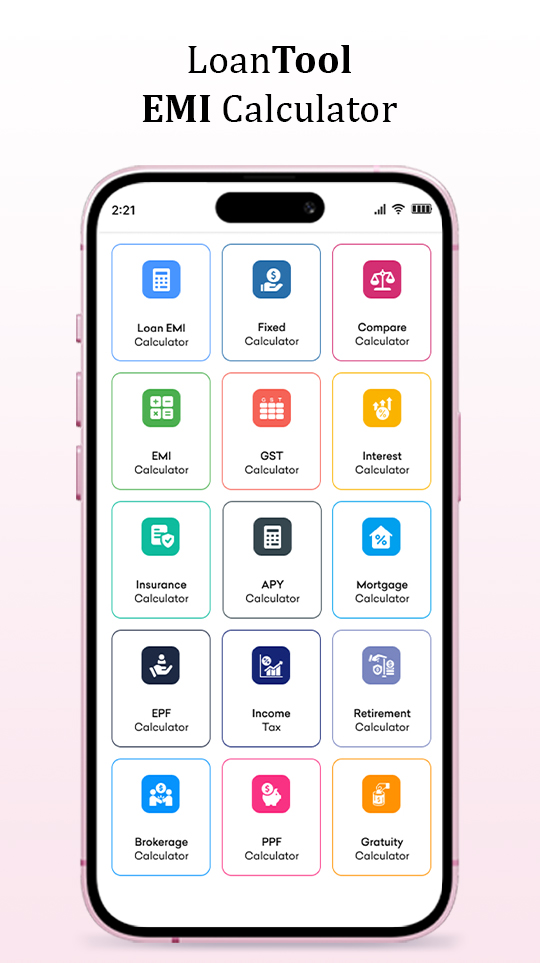

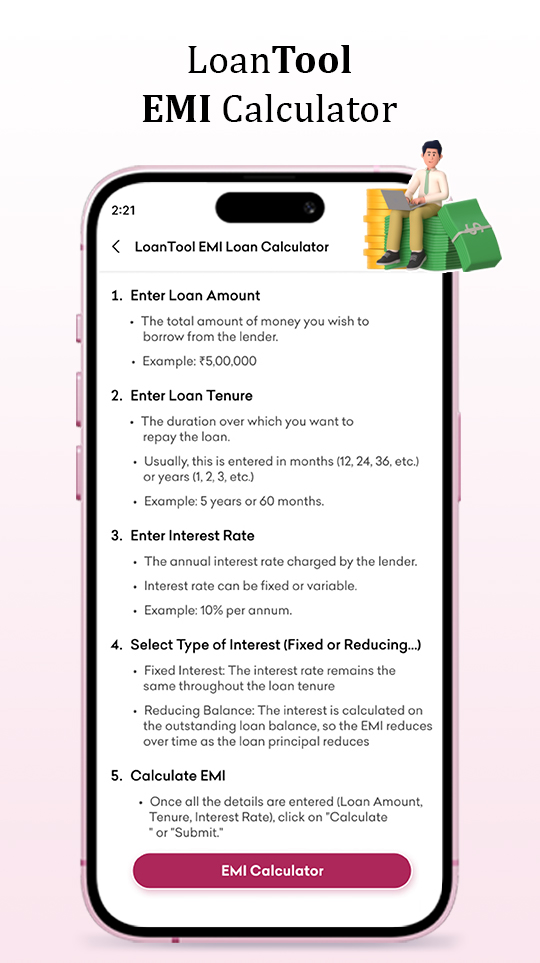

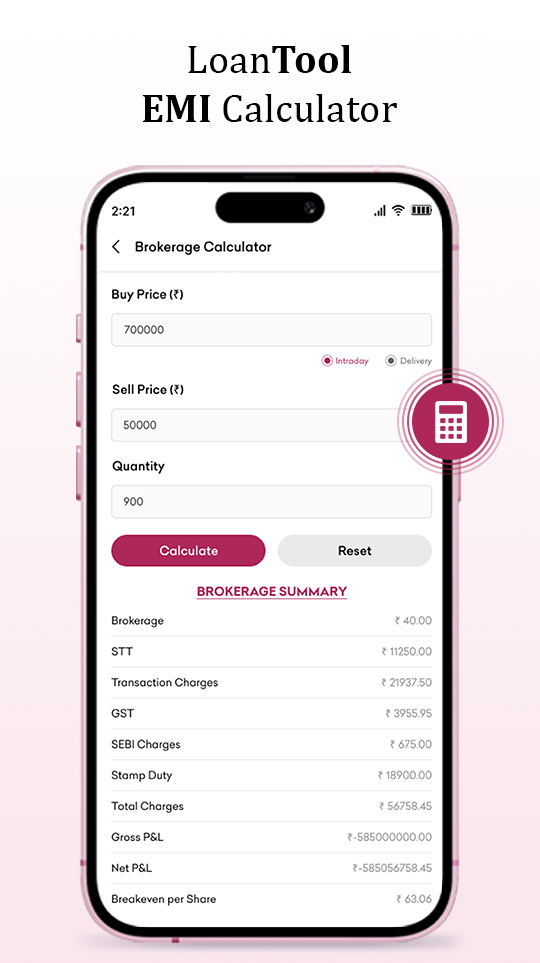

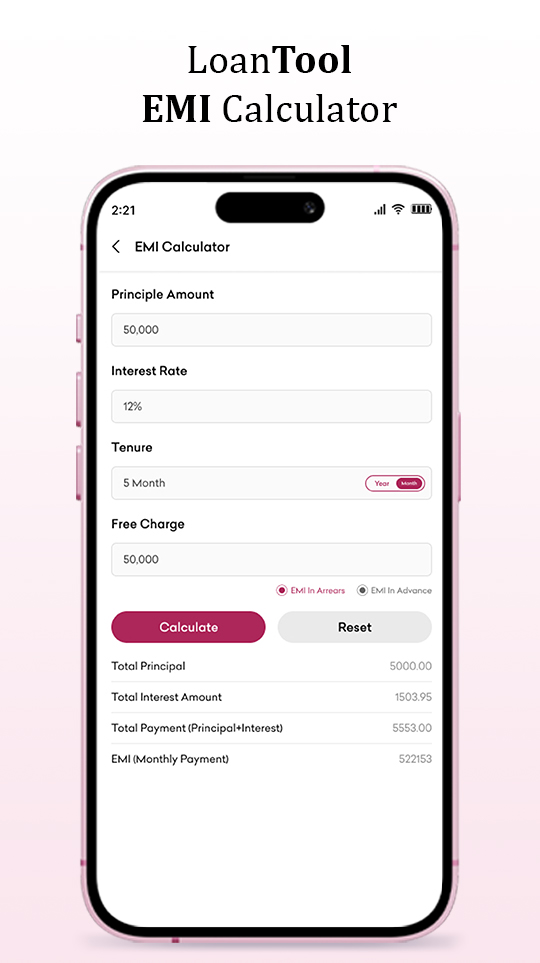

EMI Calculator Loan App : Easy calculations for Home, Car, Bike & Personal Loans

Finance

Tools

Calculators

Data Safety

Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region, and age. The developer provided this information and may update it over time

This App Share These data types with third party

This App Share These data types with third party

This app may collect these data types

This app may collect these data types

Data is encrypted in transit

Data is encrypted in transit

You can request that data be deleted

You can request that data be deleted

See details

Rating And Review

Ratings and reviews are verified and from people who use the same type of device

that you use

0.0

0

5

0

4

0

3

0

2

0

1

0

This is my first time on this app,I think its one of the

best loan app ever. Because they are working for

the interest of their customers which is their priorit...

5 people find this helpful

Was this review helpful?

Yes

No

Ui interface is too good. Very simple and effective

app

17 people find this helpful

Was this review helpful?

Yes

No

The app is very useful and easy to use, and i have

been using it for a long time now. But the worst part

is that now there are too many full screen ads and ...

87 people find this helpful

Was this review helpful?

Yes

No

See All Review

Website

Website

Email

Email

contactus@emiloan.co

Location

Location

144 Holululu Street, CT TUKAJOSI 2, #11-83(Lobby 1) Singapore 338729

Privacy Policy

Privacy Policy

About the developer

HOLULULU DATA PTE. LTD.

contactus@emiloan.co

160 TUKAJOSI ROAD #123-09

Singapore 068914

+91 98181 80000